Fire Pension Board member Jack Mortell’s research shines light on tax supposed to go for pensions

By Bob Seidenberg

Evanston City Council members may consider a small property tax increase to firm up the plan to fund police and fire pensions at 100% the actuarial required amount.

Officials have estimated the cost would be approximately $4.5 million more than at the 90% level recommended by the state.

At their special Council meeting Nov. 21, Council members held off on approving the city’s fiscal year $390 million for 2023, pushing discussion until next Monday’s regular Council meeting, to discuss details on the pension and other still outstanding issues.

Council members made the move after some members joined staff in expressing the need to use a more sustainable funding source, such as a property tax increase, to fund the pensions beyond next year.

These two pensions have been one of the city’s biggest financial liabilities over the years, regularly showing up on credit service reports flagging the high carrying costs the city is paying because of underfunded pensions.

With the city in improved financial condition this year, pension leaders have taken the opportunity during the budget process to highlight the need to fund pensions beyond staff’s proposed 90%.

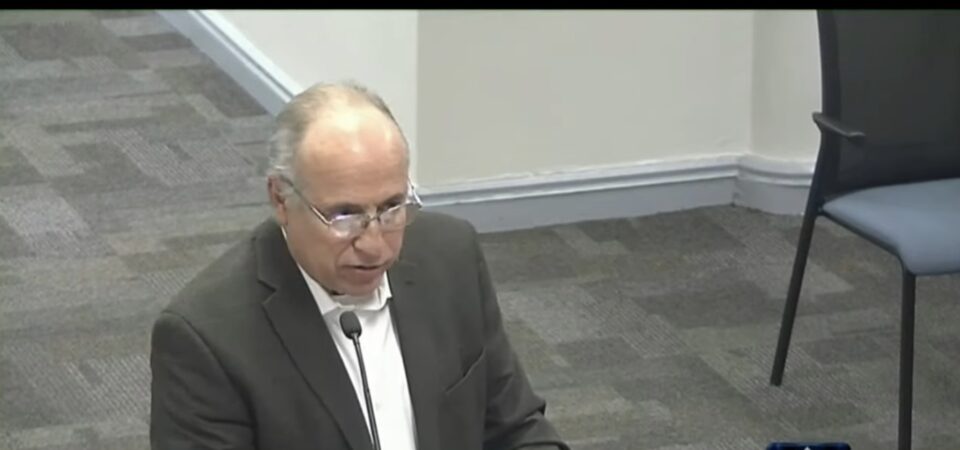

Addressing the Council during public comment, Jack Mortell, a retired Evanston Fire Department captain and twice-elected member of the city’s Fire Pension Board, told Council members, “It is time to bring real long-term real estate tax relief to Evanston’s homeowners and businesses. Fund the pensions at 100% without raising taxes. It is truly the prudent thing to do.”

Surpluses stashed in ten places, maintains Kelly

During discussion at the meeting, Council member Clare Kelly, 1st Ward, who has taken a lead role on the issue, reiterated her proposal that the city tap the its reserve fund along with revenues such as the Personal Property Replacement Tax (PPRT) to generate the estimated $4.5 million needed to fund the pensions at 100% of the actuary’s recommended amount.

Kelly, a member of the city’s Finance and Budget Committee, acknowledged that the Committee recommended a property tax that would raise $2 million, “but only if needed.”

She advocated that the city pull the main moneys from the city’s reserve fund.

Right now, she pointed out, “We have a reserve of 16.6%. That will be more than sufficient to absorb any shocks next year.”

It’s not just the reserve fund the city could pull from, she said.

“Everybody should be very clear that we have reserve balances we keep in many funds,” – as many as ten, she maintained.

In discussion, some other Council members, who also support the move to full funding, expressed reservations about relying on the reserve funds and PPRT to keep the pension funds on the 100% track beyond next year.

Council member Devon Reid, 8th Ward, suggested the decision really comes down to considering “raising property taxes to come up with half the funding, or are we going to take this fully from our General Fund/Reserves?”

“Really, either way,” he said, “I think we need to get there. I prefer to take it from General Fund reserves. But then also thinking about long term we may need to raise property taxes at some point for the long term to fund this year after year.”

Property tax hike versus reserves

Several, including Mayor Daniel Biss, moderating the discussion, referred to an email received from David Livingston, the current chair of the city’s Finance & Budget Committee, stating opposition to committing to the $4.5 million without a sustainable source such as property taxes.

“I’m interested in hearing more options myself,” said Biss.

Council member Melissa Wynne, 3rd Ward, also referred to the email.

Like other members, Wynne, the senior member of the Council, said she wanted to find a way to fund the pensions, and “not continue to kick the can down the road.”

“But I am concerned what that means,” she said, agreeing with the view suggested in Livingston’s email, “for developing a plan so that we know how much we’re going to spend every year … what’s our sustainable method of funding.”

“I’ve been on the Council long enough to know that these numbers go up and down and that even our best prediction can prove to be disastrously wrong with disastrous consequences for us,” she said.

Echoing Wynne’s concerns, Council member Eleanor Revelle, 7th Ward, said she was reluctant “to go far into the ‘projected,’ ‘anticipated,’ reserves because we do have some potentially costly expenses that are not in our budget right now,” such as the contract negotiations with employee groups now underway.

Mayor Biss also entered the conversation noting that the term “‘surplus’ is somewhat potentially artificial,” and subject to a lot of influences.

For example, he said, “We have significant federal funding that assisted us in various ways, that is proposed to be entirely expended shortly. And then we have this kind of anticipated cost trajectory related to both inflation and the collective bargaining.”

So, “I don’t know if we have the luxury of anticipating future surpluses,” he said. “I don’t think of it quite the same way as, ‘Oh, every year we get to spend our Christmas bonus, let’s decide what to do with it this year.’”

Mortell: Other options than a property tax underutilized

In his comments, though, though, during the public comment portion of the meeting, Mortell maintained that there are other options that have been underutilized that could be used rather than a tax increase for the city to meet its pension obligations.

He said the Illinois Personal Property Replacement Tax (PPRT), is a good example.

Mortell told Council members that he reviewed previous budget documents dating back to 2002 on the city’s web page to see how PPRT was budgeted.

During that time, he maintained, $17.1 million of the approximately $31.5 million the city received in PPRT funds was actually budgeted, leaving a $14.3 million surplus.

Of that total, a little over $4.2 million went to pensions, he said.

“A paltry $13.44 of the $31.5 million PPRT revenue received these past years went for pensions,” he said.

As for the period 1979-2002, “Was this a similar amount as the following 20 year period?” asked Mortell. “I really think I would not be standing here if that was the case,” he told Council members.

Sent from my iPhone