By Bob Seidenberg

City of Evanston officials’ plan for a 7.8% increase in the city’s property tax levy as a key revenue generator for their proposed 2024 budget ran into critical reactions Tuesday night, particularly since some residents had already received tax bill notices in the mail from Cook County informing them of double-digit percentage increases.

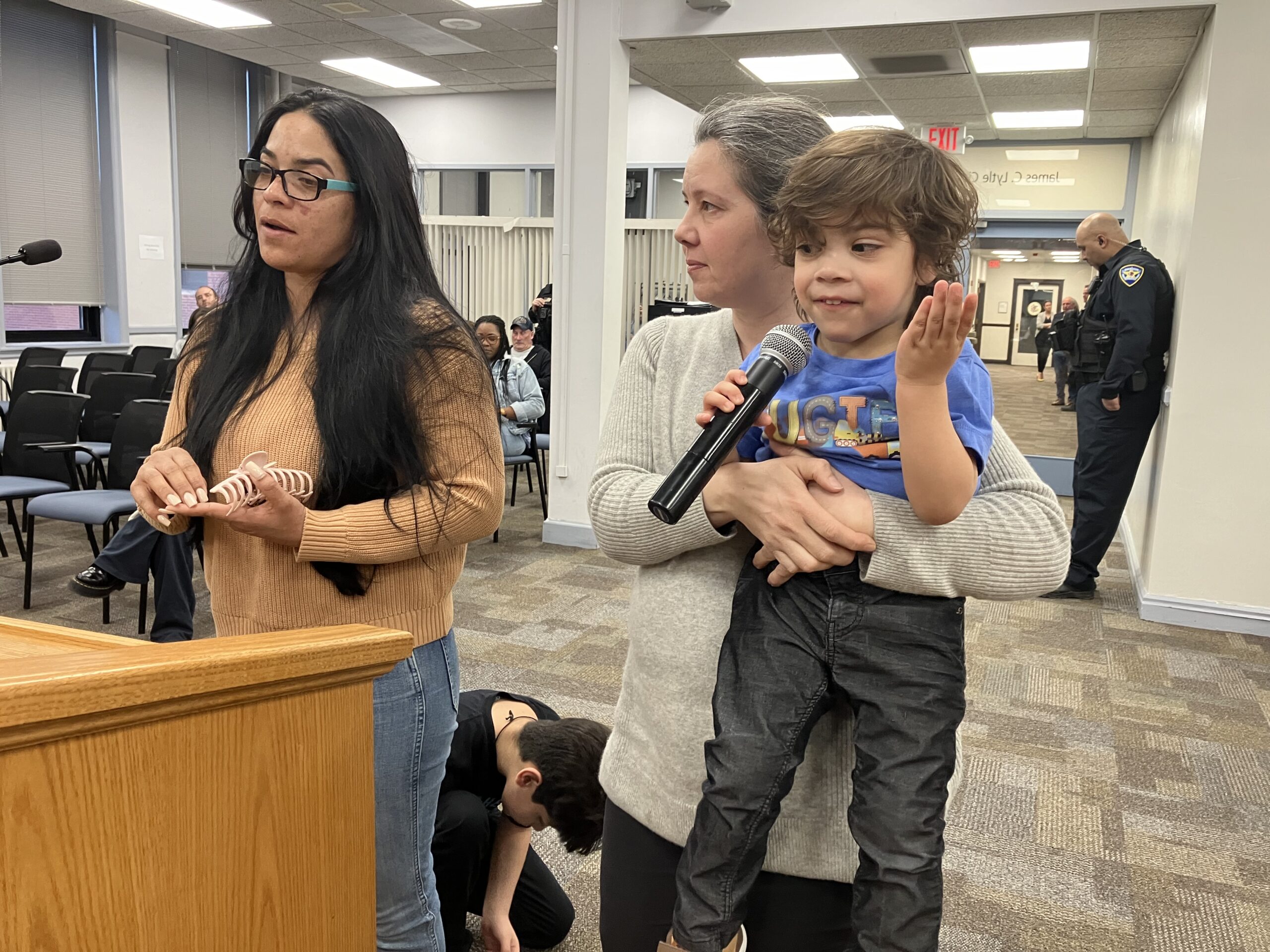

“Annually my property taxes surpass the principal of my mortgage,” protested one woman, after officials opened to questions a joint meeting of the Third, Fourth and Ninth wards at the Robert Crown Community Center.

“And also my [condo] association fees is at the highest point I know. And I have less than 1,000 [square] feet,” she said.

Officials proposed the increase to generate close to $4 million, offsetting about 30% of the cost of the wage increases the City Council approved in 2023 – raises of 11% and higher, to bring employee salaries in line with those in other communities.

With the city tapping into its $43.1 million of one-time federal COVID-19 recovery funds to build up reserves and support select capital improvement programs, its previous three budgets called for 1%, 0% and 0% increases in the city’s property tax levy. The city is responsible for about 20% of a homeowner’s overall property tax bill, with the two school districts accounting for about 70% together.

In support of the tax increase, officials have presented a chart of 2021 property tax composite rates for fiscal year 2022 at budget meetings, showing Evanston at the lower end of the list compared with neighboring communities.

‘Homeowners took a hit’: Pappas’ office

Residents in the north and northwest suburbs have begun receiving the second installment of 2022 tax bills, mailed Nov. 1, in their mailboxes.

“Homeowners took a hit,” concluded an analysis office of Cook County Treasurer Maria Pappas. Researchers examined the 1.8 million bills to look at trends.

“The median residential tax bill increased by 15.7%,” the analysis found, “the largest percentage increase in at least the last 30 years, while the median commercial bill increased by 2.2%.”

At Tuesday’s joint ward meeting, Clayton Black, the city’s budget manager, took notice of nods and murmurs in the filled Robert Crown room as he began discussing the findings of the city’s study, showing its taxes are on the lower side of neighboring communities.

“I’m sure you got your tax bill and you’re saying, ‘What do you mean our rates are lower? My tax bill went up,’” Black said

“Unfortunately,” he said, “we don’t have control over the assessed value of properties that is set by Cook County.”

Pappas’s office, in the analysis, said a number of factors are at play on whether homeowners and commercial property owners have to pay more. They include, first of all, whether schools, municipalities, park districts and other taxing bodies have increased their levies. School districts, meanwhile, are limited by tax caps as to how much they can annually increase their levies.

Other factors include whether an individual assessment rose or fell in relation to the assessments of other homes and businesses.

Salary increases of 11% to 18%

City officials have defended the proposed property tax hike as necessary to cover the already approved wage increases. Without it, they say, they could be dipping into the city’s reserve fund, which could run into steep deficits as early as 2025.

As part of new labor agreements, wage increases for police officers are as high as 18%, with most other employees at 11%. The increases grew out of a wage study completed in 2022, that recommended aligning salaries more closely with comparable communities.

Police officers, in particular, were underpaid, according to the study, City Manager Luke Stowe noted at the meeting. The city had been seeing officers leaving for other communities, where better pay packages were available. The police department at one point had as many as 30 vacant posts.

Better off in Des Plaines?

Hitesh Desai, the city’s chief financial officer and treasurer stressed at the meeting that he wasn’t trying to hide the wage report’s findings; in fact, he had referred residents earlier to coverage of the analysis and encouraged them to read it.

But at the meeting, one woman reported her property tax bill has already gone up more than 20%. “My bill would have been a lot less in Des Plaines,” she said, “because they have industry and commercial properties that take some of that” off.

Some of the recent increase may have been fueled by a shift in the tax burden from commercial to residential in recent years, Desai said. In addition, he referred to a recapture provision highlighted in Pappas’s report – a new state law allows school districts and many local governments to recover or “recapture” money refunded to property owners who successfully appealed their taxes in the previous year. The result was that $203 million was tacked onto current property tax bills.

Moving on from the discussion about property taxes to the budget in general, Black told audience members, “Sorry about that. I mean, I fully expected everybody to not love this part of the presentation.”

The meeting was the last of the budget ward meetings. City Manager Luke Stowe and his team have been present to explain the budget and receive feedback. The budget returns to City Council on Monday, when council members are scheduled to start putting together the final pieces.

The city’s total proposed budget for 2024 is $449 million, a whopping $51.8 million increase from the 2023 budget.

A water rate hike too

One budget critic at the city’s Truth in Taxation hearing Nov.. 6, charged it contained everything but “the kitchen sink.”

The increases include:

- $19.4 million for salaries and wages.

- $15.2 million for the city’s Capital Fund.

- And additional increases in water system improvements, the motor fuel tax fund and federal American Rescue Plan Act fund ($12.6 million) that have already been allocated but not spent, and so go on the 2024 budget.

The budget also includes a 17.55% increase in water rates to cover the cost of water main and lead service line replacements that will add approximately $70 annually to residents’ water and sewer bills.

“Right now we’re proposing to replace 3.2 miles of water mains each year,” Darrell King, the city’s water production bureau chief, told residents at the meeting.

“And the reason we want to do that is because in 20 years … in 2042, if we don’t double the amount of water mains that we have [replaced], we would end up with 26.7 miles of water main that’s 120 years or older,” he said. “And that’s unacceptable.”

The property tax hike, if approved, would add approximately $130 a year for the owner of a home valued at $400,000, officials estimate.

At the Crown meeting, longtime city budget watcher John Kennedy said that city staff is basically saying, “Keep throwing a lot of ideas into this,” which results in the $449 million figure.

He noted that actual spending figures showed the city’s total budget growing from $273 million for 2022 to the proposed $449 million, roughly a 65% increase.

“I’ve been to a number of hearings on this and I have seen no evidence where the council members are actually taking serious proposals [to lower that number] and making decisions on it, and we’re running up against a deadline,” he said, referring to next Monday’s council meeting, where the final process will begin.

Three council members polled

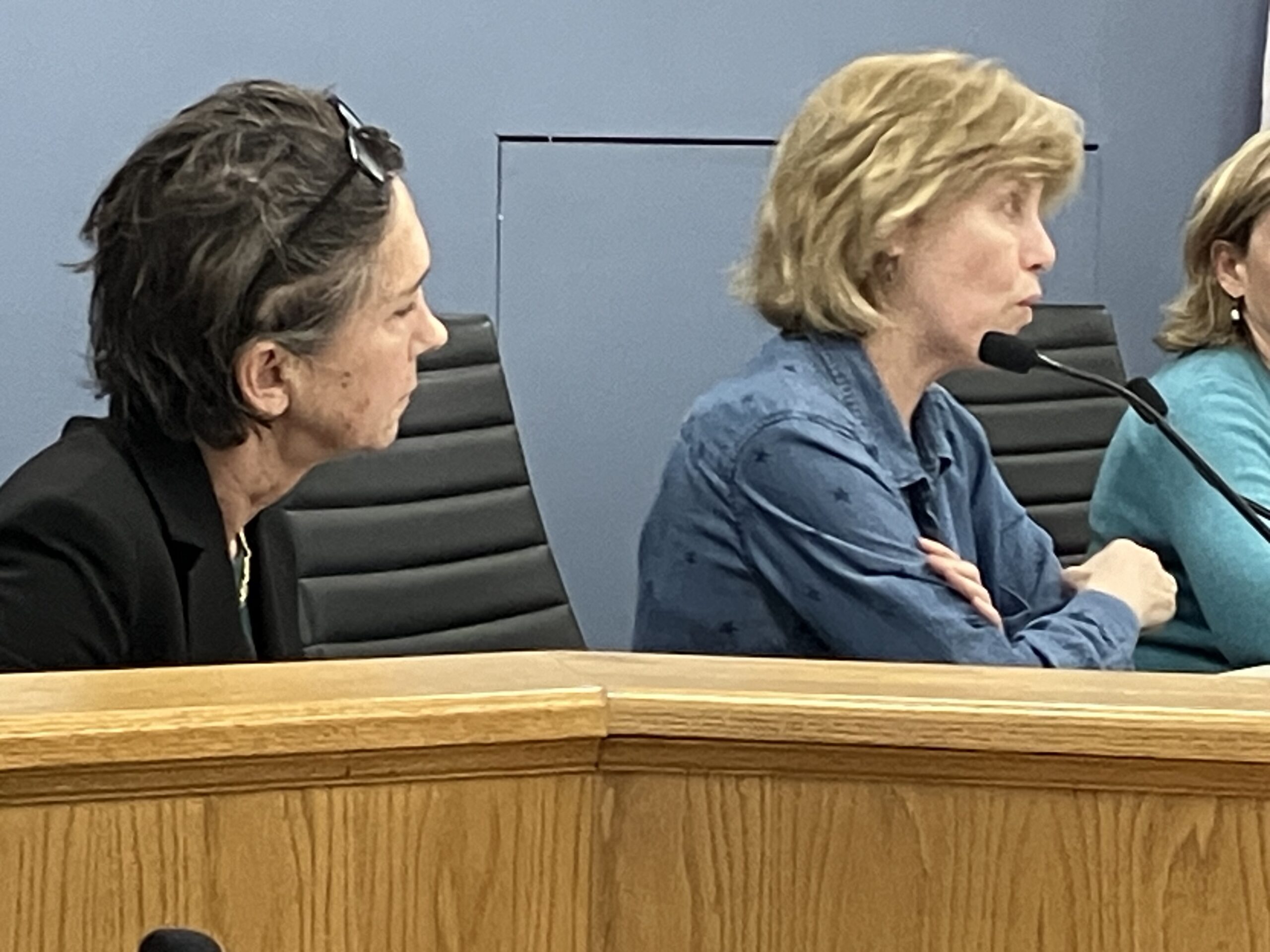

He asked the council members at the joint meeting – Melissa Wynne from the Third Ward, Jonathan Nieuwsma from the Fourth, and Juan Geracaris from the Ninth – whether they intended to the support the $449 million or would work for something less.

Council Member Geracaris redirected the question back to Kennedy, asking that Kennedy tell him where council members should make cuts, “because I don’t want to cut services, and we can’t cut staff.”

Geracaris, who was appointed to the council in February 2022, said he’s found in the more than a year and a half since then that “staff does a great job. I think the breadth of services and what we do for the citizens is fantastic.”

The city has a lot of old infrastructure that officials will eventually have to deal with, he said.

“When I look at the capital Improvement plan, I know our parks are way behind being upgraded,” he said. But he added that the city’s roads and infrastructure need immediate attention.

He said that with a green space plan in the works for the city’s parks, he would prefer the city hold off on work in that area until it’s done.

Council member Wynne, the senior member of the council, said she agreed with Geracaris, and wouldn’t want to cut staff either. If services were to be cut, what would they be? she asked. Garbage pickups? And she added, “the city’s fire response “is second to none, and one we want to maintain.”

“We have a lot of capital needs,” she said, referring to the city’s capital improvement program.

“If we sit on them any longer,” she said, “a deferred capital project is a project that costs two or three times as much.”

She wasn’t ready to announce an across-the-board, certain figure for the budget, but maintained that “every single one of these positions, every single dollar in our budget,” supports good services.

Council member Nieuwsma, speaking last, said his focus is on the capital project side. “Our capital needs are this,” he said, raising his hand above his head. “We can easily spend this much money on stuff that needs to get done for the benefit of our communities.”

But “we’re only putting this much into it,” he then said, dropping his hand low. “All that is going to mean is that it’s going to cost even more sometime. And trying to find the right balance of what do we need to do or what we can put off – and how much more is it going to cost us later, and making imperfect perfections, is the best we can do.”

For the final budget, Nieuwsma said, “we’re going to end up with something that I think is going to be a little bit lower.”

But if the council fails to act now, “there are going to be capital projects that are going to end up costing my kids, if they still live here in 20 years, more out of their 2043 paychecks,” he said.