By Bob Seidenberg

The city’s Finance and Budget Committee wants to pay for $17.7 million in capital improvement projects by issuing long-term bonds, despite some members’ reservations about the funding process.

Committee members voted 6-2 Tuesday, March 21, to support the staff resolution which authorized payments for major projects in the city’s Capital Improvement Project (CIP) Fund, Library Fund and Water Fund. The matter now goes to the full City Council.

The issuance of General Obligation bonds has been a long-time tool of the city to finance projects, spreading out payments generally over a 20-year period and avoiding the steep hikes in property taxes that would come with paying them all at once.

Hitesh Desai, the city’s Chief Financial Officer/Treasurer, described the resolution as a procedural action.The pay-as-you-go approach, though, has come under scrutiny in recent years and particularly as related to the financing of the Robert Crown Community Center.

That project ran higher than $20 million over the city’s target budget, and has the city making debt service payments close to $3 million annually starting this year, and running until 2043.

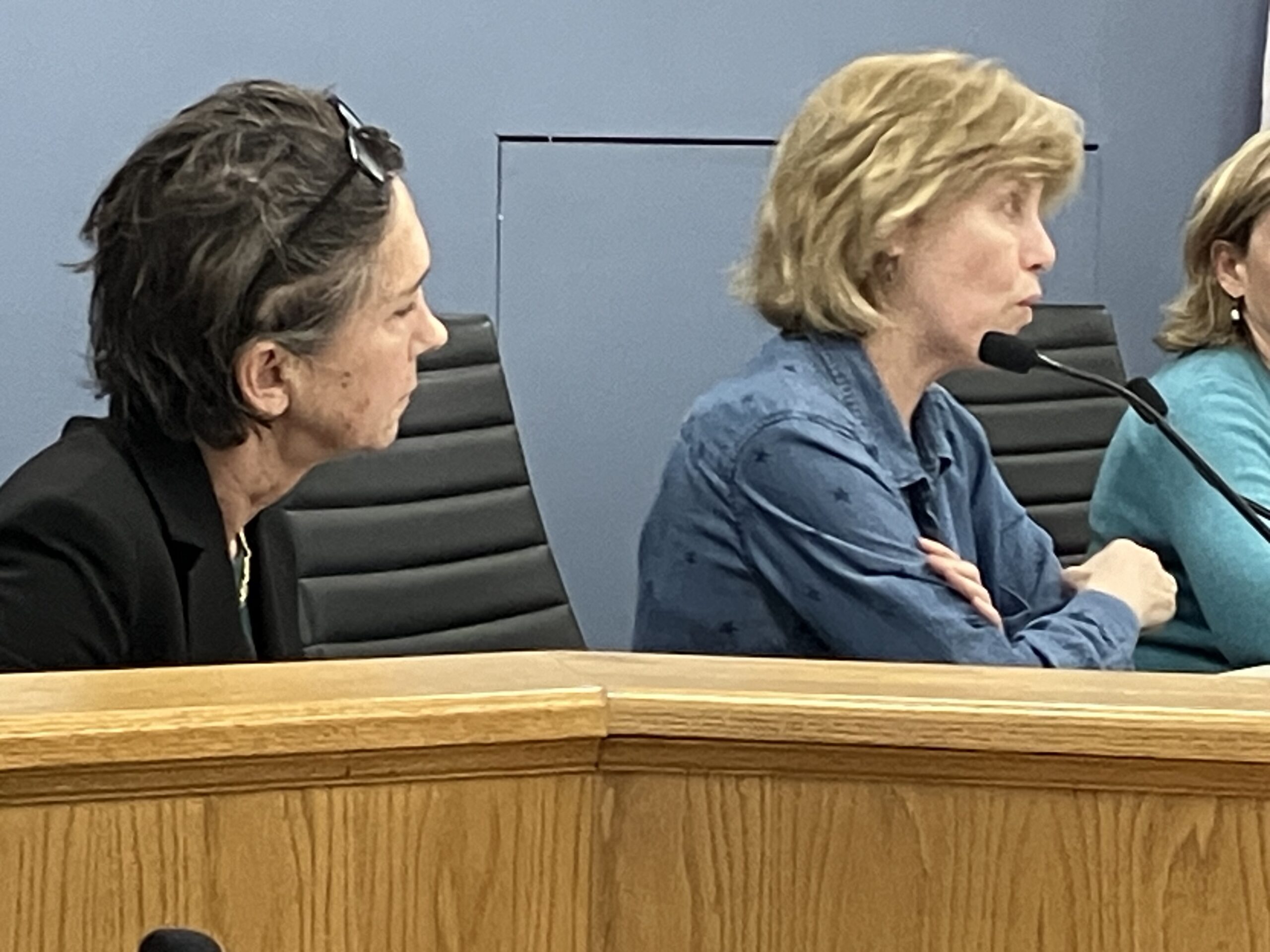

Committee member Leslie McMillan urged committee members to consider tapping the city’s General Fund reserves to reduce the amount of the bond issuance.

Officials initially projected the General Fund surplus at $14.1 million for 2023, using revenue and expense information that was available October of last year. Officials upped that figure to closer to $24-$25 million at the end of February, based on more recent information.

McMillan said she was really “struggling” with the notion of the suddenly-found $10 million.

“If you’ve already found $10 million,” she said to city staff, “I guess I don’t know why we really have to go back and refund the General Fund” (through the bond issuance.)

In his memo and comments to the committee, Desai pointed out that that in October, city staff members were conservative in considering the impacts of inflation on major revenues. Cook County also had been delayed sending out 2021 second installment property tax bills, making estimates difficult.

In addition, staff has plans to discuss with Finance & Budget members other developments that might impact the surplus, including covering the higher-than-budgeted wage increases for police and fire, covering incremental pension increases, and dealing with potential transfers to other funds that have a negative fund balance, such as the Insurance fund, he said.

McMillan, whose expertise is in finance, observed, however, that the city was able to manage debt costs as rates were falling for 20 years.

“That worked. But now we’re in a very different environment. We’re in an environment where our debt rolling off in two handles and we’re rolling debt on in the five handles.”

To issue more debt, she maintained, “it’s just going to cripple the city.”

David Livingston, the chair of the committee, agreed with McMillan, that “we absolutely need — and we’ve discussed this as a group — the need to continue to refine our revenue tools, so any point in time, we have a better view of the current year and a better view of the near-term years so we’re working on multiple streams.”

For now, he suggested, the group should focus on refining its projections, “and we can look at what our areas to cut, what are areas to raise revenue — how do we get better visibility on some of these revenue streams.”

Council member Clare Kelly, 1st Ward, noted that in recommending to approve the resolution obligating the city on General Obligation bonds up to $17.7 million, “that’s an expenditure. That’s like a million dollars a year in finance and interest fees.”

“We all understand this is not a bond hearing or that we’re approving the actual bond,” she said. “It’s giving direction to staff — if you need to leverage $17.7 million on the taxpayers for the next 20 years at a fee of over a million dollars a year to finance that — we’re fine with that.

“And I’m not fine with that,” she said.

The $17.7 million only accounts for a ‘fraction’

Lara Biggs, responding to a question from Council member Jonathan Nieuwsma, 4th, confirmed that the $17.7 million represents only a fraction of the city’s total capital needs.

“There are a lot of vague, open ended questions right now in the capital program,” she said, “because we have several facilities that needs substantial work and we haven’t got an approved plan on how we’re moving forward with some of them and we don’t have approved plan for funding others, which is something staff is has been working on to get that information together.”

But this year, she said, after working with the council to set focus on the projects for 2023, the number of projects comes to significantly less than what had been projected for the next five years, she

Ultimately, she said, “we have a number of facilities and park infrastructures where we’re going to be either making emergency repairs, or in other cases, shutting down buildings and removing playground infrastructure, she said.

Nieuwsma noted that the Council has already approved a CIP plan for the city. “So the task now for the Finance & Budget Committee is to help figure out how to pay for it.”

“So I guess I’m prepared to vote in favor of this resolution knowing that it’s not a commitment to issue these bonds. We still have an opportunity to do some value engineering and cost cutting when and if it might be appropriate.”

Committee members voted 6-2 in support of the resolution, moving the issue next to the full Council.