By Bob Seidenberg

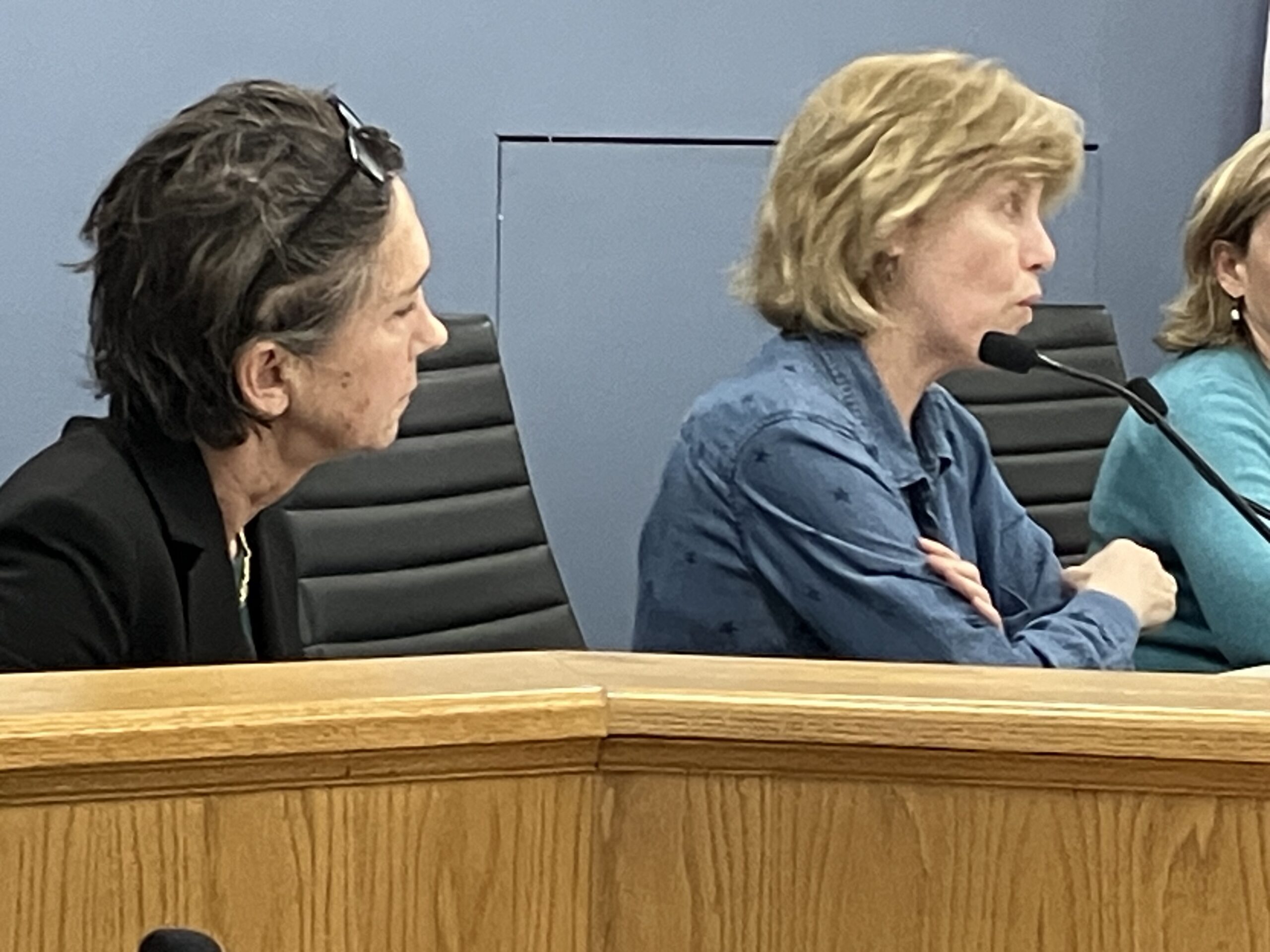

Repeating what she said at the City Council meeting this week, First Ward Council member Clare Kelly reiterated that Evanston should step up contributions to the police and firefighter funds, striving for 100% funding by the state’s 2040 target date.

At the First Ward meeting on Thursday, Oct. 20, Kelly responded to a presentation from Hitesh Desai, the city’s chief financial officer, in a review of the 2023 fiscal year budget now before the Council.

Desai spoke in support of the payment schedule the city currently follows, saying Evanston’s contributions exceed the state minimum required to reach 90% funding by 2040.

“Over the past 10 years, the city of Evanston has contributed $35 million more than the [annually required] state minimum,” he noted. “But the dilemma for the City Council is if they want to contribute more, they have to levy more, and that means a burden on the residents of a higher property tax,” he said, acknowledging that council members face a tough decision.

But Kelly pointed to the rising debt obligation costs the city has incurred over the years by paying the only the state minimum. “It just increases the burden,” she said at the meeting, aired virtually.

Through much of the 1980s and 1990s, the city ranked near the bottom of the list of Illinois municipalities meeting its pension obligations.

The funding for the city’s police and firefighter pensions now stands somewhere between 50% and 60%, Desai said at the meeting.

Responded Kelly, “So, for example, we’re up to – and this is an approximate number – $240 million, whereas, like 15 years ago, we were at $140 million,” she said.

She estimated the money needed to get on track for 100% funding at $4.3 million. At the Oct. 17 special Council meeting, Mayor Daniel Biss also went on the record, saying the budget’s proposed contribution amounts are insufficient.

Kelly, a member of the city’s Finance and Budget Committee, said that group is planning a more in-depth discussion of the issue at a Nov. 1 meeting, which will be aired over Zoom.

Leslie McMillan, also a member of the Finance and Budget Committee, said that in discussions there are three or four salient issues that have come to the surface in the group’s examination of the city’s financial issues.

“Foremost, as Council member Kelly has pointed out, we want to stop the exponential growth of our pension obligations,” said McMillan. “And to do that, all of us through the three community members (on the committee) feel very strongly we need to get to 100% as soon as possible. That’s just going to be an exploding number.”

There are several ways to do that, said McMillan, whose background is in finance. “There’s about $4.5 million of additional expenditures we need to make to meet that goal. And I think most of us feel we can do that, but it’s going to take some belt-tightening.

“Some of us on the committee feel like there’s been a lot, maybe (in) expenditures in the past we should not have made or should have examined more closely or just right-sized,” she said, “and so I think we need to take a hard close look at our capital improvement budget yet again.

“We need to examine some of the things in that budget still, like the $6-$7 million cost for a new animal shelter. Things in this coming year (where) we’re really looking at either a soft or hard landing in the economy, is that how we should be spending our money?”

She said the committee has also asked city to look shrinking the overall $402 million city budget or shrinking the balance sheet.

“What that means,” she said at the ward meeting, “is not carrying as much cash on our balance sheet, and not carrying as much debt. So making sure that we resize everything, and get to a smaller number so we can afford what we absolutely need.”